Chinese electric vehicle (EV) maker Nio (NYSE: NIO) recently announced another strong month of vehicle deliveries. Last week’s announcement has helped push Nio shares higher. But other news concerning its domestic market and its newest luxury EV has even more investors piling in today.

Nio shares have soared about 20% so far in December. That includes a jump of 11.8% today, as of 10:30 a.m. ET.

Are You Missing The Morning Scoop? Breakfast News delivers it all in a quick, Foolish, and free daily newsletter. Sign Up For Free »

Today’s boost came after Chinese government leaders promised to implement “more proactive” fiscal policy next year as well as looser monetary policy to help boost domestic consumption. That bodes well for Nio as it hopes to get to another level of EV unit sales.

At the same time, Nio announced China’s Ministry of Industry and Information Technology (MIIT) has approved Nio’s flagship executive sedan to be the first mass-produced vehicle in China to feature steer-by-wire technology.

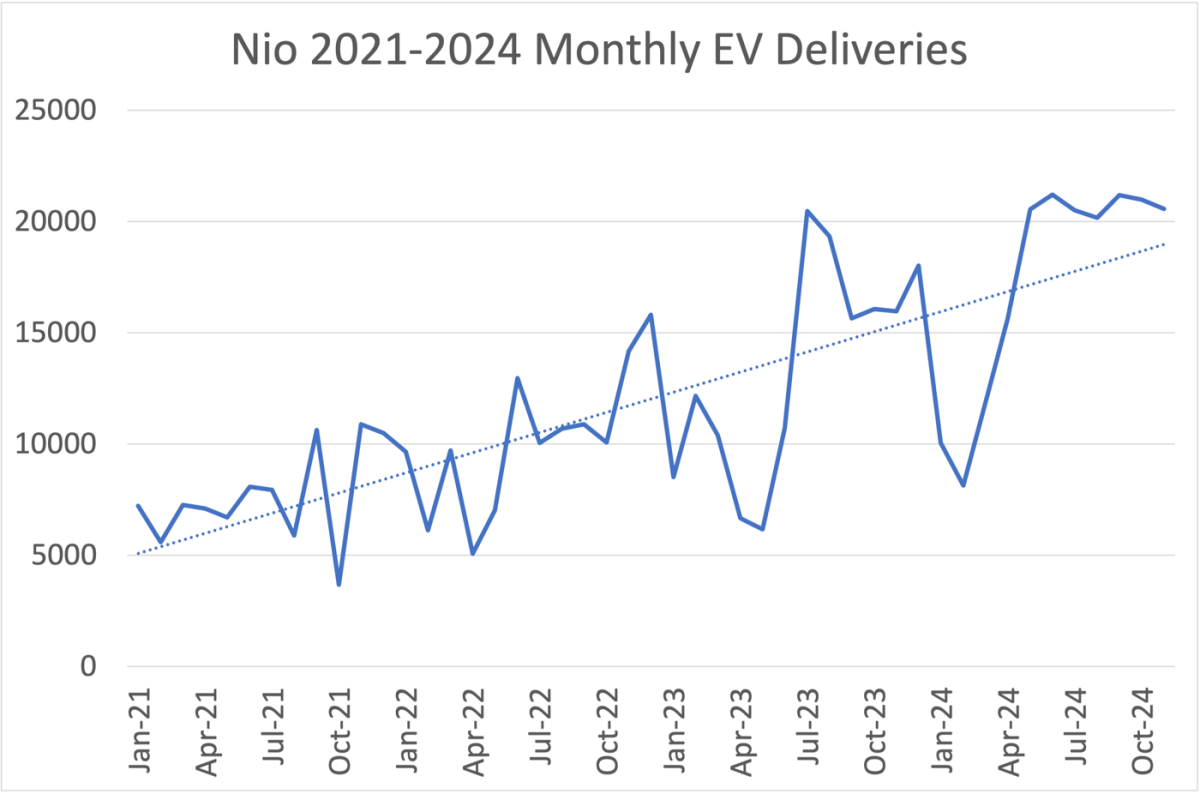

November marked Nio’s seventh consecutive month of delivering more than 20,000 electric vehicles.

That comes as Nio is preparing to begin sales of its ET9 luxury sedan in the first quarter of 2025. That flagship model is targeting executive-level buyers with a starting price of the equivalent of over $110,000. One of the features of the ET9 is its steer-by-wire system providing improved handling and rider experience. It will now become the first mass-produced model to be equipped with the technology after MIIT approval.

Separately, over the weekend, Chinese officials said that moving forward monetary policy would be “moderately loose.” That’s a change from its previous stance and could help spur Chinese consumers to purchase new electric vehicles.

That combination of news has investors getting more optimistic about Nio’s prospects for increased sales growth in 2025.

Before you buy stock in Nio, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nio wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $872,947!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

Source link