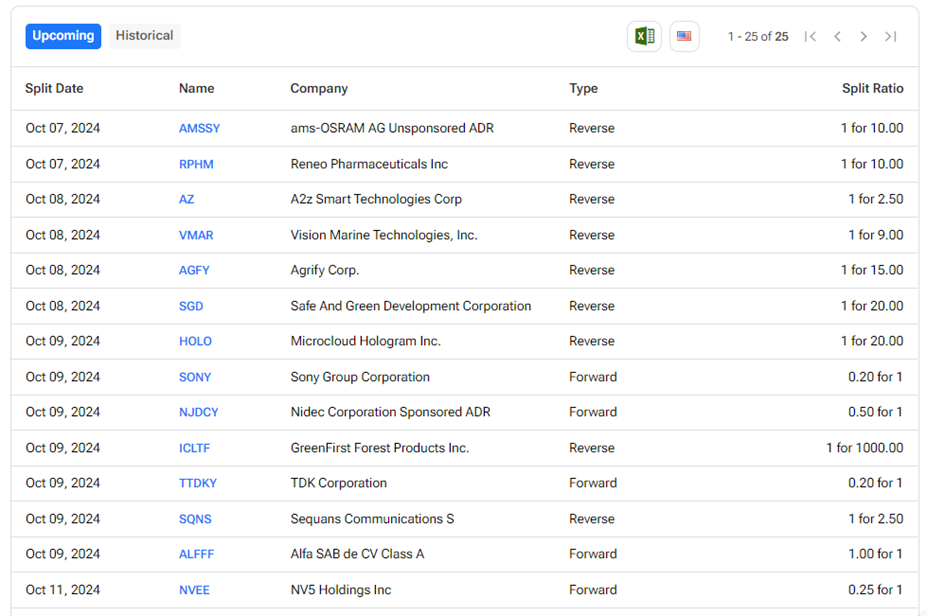

Upcoming Stock Splits This Week (October 7 to October 11) – Stay Invested

These are the upcoming stock splits for the week of October 7 to October 11, based on TipRanks’ Stock Splits Calendar. A stock split is a corporate action in which the company issues additional common shares to increase the number of outstanding shares. Accordingly, the stock price of the company’s shares decreases, which maintains the market capitalization before and after the split.

In contrast, there are also reverse stock splits that reduce the number of outstanding shares (consolidate). In this case, too, the market cap is maintained as the share price increases following the reverse stock split.

Companies often undertake stock splits to improve the liquidity of the common shares and make them more affordable for retail investors. Let’s look quickly at the upcoming stock splits for the week.

ams OSRAM AG (AMSSY) – Austria-based ams OSRAM AG is a semiconductor company that manufactures advanced light and sensor technologies. The company’s unsponsored ADRs (American Depositary Receipts) are set to undergo a one-for-ten reverse stock split. The ADRs are expected to start trading on a split-adjusted basis on October 7.

Reneo Pharmaceuticals (RPHM) – Reneo Pharmaceuticals is a clinical-stage biopharmaceutical company focused on developing precision medicines that target biologically validated drivers of cancers that are underserved by available therapies. On October 4, Reneo completed its merger with OnKure Therapeutics. For the merger, Reneo effected a one-for-ten reverse stock split of its common stock. Shares are expected to start trading on a split-adjusted basis and under the new ticker symbol “OKUR” on October 7.

A2Z Smart Technologies Corp. (AZ) – Israel-based A2Z Smart Technologies Corp. develops and markets smart technological systems for the retail market as well as for the defense and security markets. A2Z announced a one-for-2.5 reverse stock split of its common stock, effective October 8. The purpose of the split is to comply with the Nasdaq’s minimum bid price requirement for continued listing.

Vision Marine Technologies (VMAR) – Vision Marine Technologies designs and manufactures electric outboard marine powertrain systems and related technology. On October 4, VMAR announced a one-for-nine reverse stock split of its common stock. The split, which will be effective on October 8, is being undertaken to increase the per share market price of VMAR’s common stock and regain compliance with the Nasdaq’s minimum bid price requirement.

Agrify Corp. (AGFY) – Agrify provides innovative cultivation and extraction solutions for the cannabis industry. On October 4, Agrify announced a one-for-15 reverse stock split of its common stock to satisfy the minimum bid price requirement of the Nasdaq’s listing rules for continued listing. Shares are expected to start trading on a split-adjusted basis on October 8.

Safe & Green Development Corp. (SGD) – Safe & Green Development Corp. operates through its unit SG DevCorp, which is a real estate development company. It focuses on building innovative and green, single or multifamily projects across all income and asset classes. SGD announced a one-for-20 reverse stock split of its common stock to regain compliance with the Nasdaq’s minimum bid price requirement. Shares are expected to begin trading on a split-adjusted basis on October 8.

MicroCloud Hologram (HOLO) – China-based MicroCloud offers software and hardware holographic solutions. The company’s holographic technology is used in multiple fields, including content services, smart car holographic fields, and holographic cloud data processing. On October 2, HOLO announced a one-for-20 reverse stock split of its Class A ordinary shares, effective October 9. The stock split will help HOLO regain compliance with the Nasdaq’s minimum bid price requirement for continued listing.

Sony Group Corporation (SONY) – Japan-based Sony Group manufactures and markets electronic instruments, equipment, devices, game consoles, and information technology-related products. Sony’s ADRs (American Depositary Receipts) are expected to undergo a five-for-one stock split effective October 9.

Nidec Corp. (NJDCY) – Japan-based Nidec Corp. manufactures and distributes industrial and electric motors. The company announced a two-for-one stock split of its common stock, effective October 9.

GreenFirst Forest Products (ICLTF) – Canada-based GreenFirst Forest Products engages in sustainable forest management and lumber production. On September 27, the company announced a one-for-1,000 reverse stock split of its common stock. Shares are expected to start trading on a split-adjusted basis on October 9.

TDK Corp. (TTDKY) – Japan-based TDK Corp. is a comprehensive electronics components manufacturer. TDK announced a five-for-one stock split of its ADRs (American Depositary Receipts), effective October 9.

Sequans Communications SA (SQNS) – Sequans is a semiconductor company that produces a portfolio of 5G/4G operator-certified chips and modules. On September 27, SQNS announced a one-for-2.5 reverse stock split of its ADS (American Depositary Shares). The stock split will change the ratio of ADS to ordinary shares from one-to-four to one-to-ten. Effective October 9, the ADS will start trading on a split-adjusted basis.

Alfa SAB de CV Class A (ALFFF) – Mexico-based Alfa SAB de CV or Alfa Group manufactures and markets specialty chemicals for industrial uses. The company announced a rights issue of its shares in the ratio 1:1, with an ex-date of October 9.

NV5 Global (NVEE) – NV5 Global provides technology and consulting services for public and private sector clients related to infrastructure, utility, and building assets and systems. On September 25, NVEE announced a four-for-one stock split of its common stock to increase the liquidity and attractiveness of its shares. Shares are expected to start trading on a split-adjusted basis on October 11.

To find more information about historical and upcoming stock splits, visit the TipRanks Stock Splits Calendar.

Source link