(Bloomberg) — After a 150% rally that’s added about $60 billion in market value, Wall Street thinks Palantir Technologies Inc. has gotten way ahead of itself.

Most Read from Bloomberg

Shares in the company, which makes data analysis tools for companies and governments, have soared this year, helped by its inclusion in the S&P 500 Index in September and its success in leveraging artificial intelligence. But analysts don’t expect the winning streak to continue, with the average target implying a decline of more than 30% in the next 12 months — the most downside seen for any stock in the US benchmark, according to data compiled by Bloomberg.

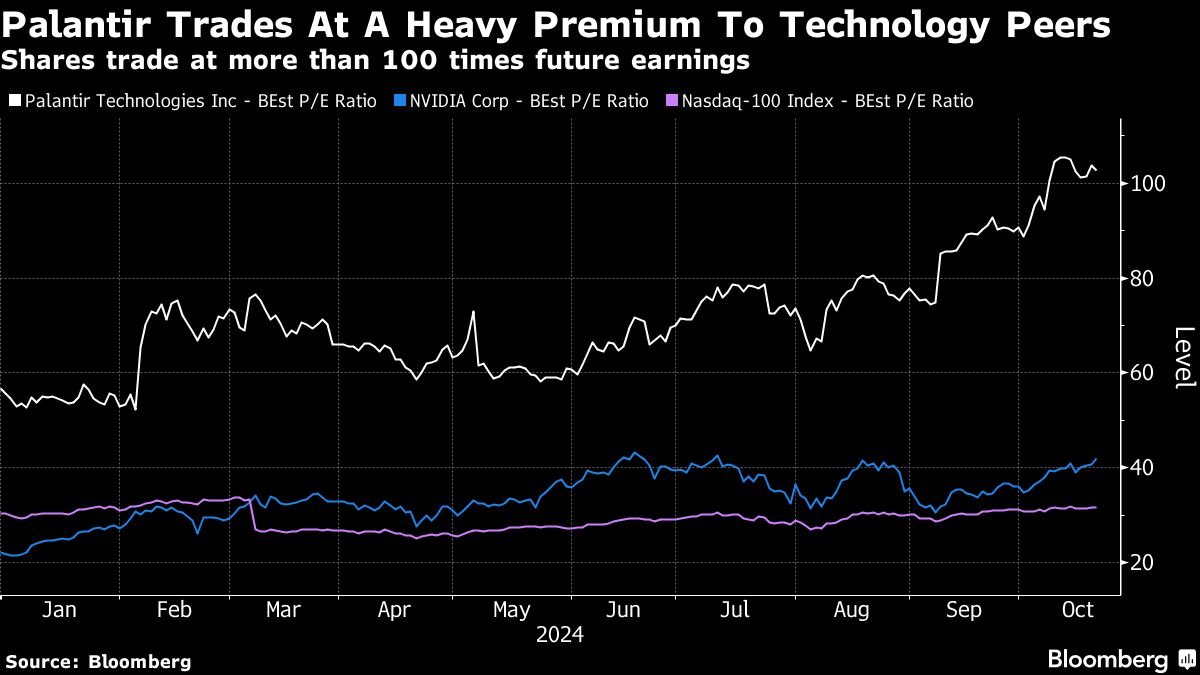

Their caution mainly stems from Palantir’s lofty valuation. The shares trade at more than 100 times future earnings, a hefty premium over other AI names, some of which are also considered too pricey by investors. Nvidia Corp. has a multiple of about 37 times forward earnings, while software firm Oracle Corp., which has also been riding AI-related tailwinds, trades at just 26 times.

Palantir shares “need to consolidate stellar gains over the last couple of years and grow into its rich valuation,” Raymond James analysts led by Brian Gesuale wrote in a recent note, downgrading the stock. The rally mean Palantir has “no room for error” when it reports earnings next month, he added.

Palantir shares rose as much as 2.2% in early trading Thursday.

While Palantir is now the third-best performer on the S&P 500 this year, behind Vistra Corp. and Nvidia, analysts are unusually negative for an AI-exposed name. Among 21 firms tracked by Bloomberg, only four recommend buying the stock, while ten have hold ratings and seven rate it a sell. The company’s co-founder and chief executive officer, Alex Karp, has a love-hate relationship with Wall Street, and has said that analysts don’t understand the company.

Still, shares have kept on soaring, helped by the success of Palantir’s AI tools, which have pulled in new customers including CBS Broadcasting, General Mills Inc. and Aramark Services Inc. this year. The company has also continued to win big contracts with government agencies in the US and allied countries, with government revenue making up the majority of overall sales.

Some Palantir investors agree that the stock may see volatility after the huge rally.

“It’s come so fast, there’s going to be bumps along the way,” said Joe Tigay, portfolio manager at Equity Armor Investments LLC. “With such an extremely high valuation, it can fall on bad news,” he said, adding that Palantir potentially has significantly more room to run.

The next test of the stock will come when Palantir reports results in November. Analysts estimate third-quarter revenue of $702 million, up 26% from last year, with earnings growth of 28%. Investors will also be looking for updates on new customers.

“I’m more concerned about their total clients,” said Tigay, adding that growing the client list is more important for Palantir in the short term than the bottom line.

Jim Worden, chief investment officer of Wealth Consulting Group, said that while the stock may be volatile into earnings, that doesn’t have to be bad, and could mean more upside. At the same time, Palantir’s business with government agencies provides an anchor.

Palantir has “this first mover advantage — the government contracts are sticky and there’s a high cost to switch,” said Worden, who also owns the stock. The company has won a range of recent government contracts, including for building out an AI platform for the military.

Still, the big driver for further growth will be winning more corporate customers for its AI platform, released in 2023. Palantir has been trying to bring in more customers by hosting boot camps, which bring together the company’s engineers with potential and current customers to test out its software.

“They’ll have to show tangible incremental progress with their AI boot camps,” said Hilary Frisch, director and senior research analyst at ClearBridge Investments LLC, who also holds the stock. “If they show incremental progress at the margins that would be positive.”

Frisch said that recent gains for Palantir have probably been driven by retail investors, not institutional ones, while its recent addition to the S&P 500 may have caused some volatility. The inclusion means the company will be added to index-tracking funds held by major investors.

After the boost from being added to a major index, companies often have to spend some time growing into their valuation, Frisch said.

Top Tech Stories

-

Tesla Inc. shares climbed in early trading after the carmaker reported surprisingly strong earnings and forecast as much as 30% growth in vehicle sales next year.

-

Nvidia Corp.’s Jensen Huang struck a partnership with Asia’s richest man, Mukesh Ambani, to build out artificial intelligence infrastructure and spur the technology’s adoption in the world’s most populous country.

-

SK Hynix Inc. posted record quarterly profit and revenue, reflecting strong demand for the memory chips used with Nvidia Corp. processors for artificial intelligence development.

-

Taiwan Semiconductor Manufacturing Co. discovered this month that chips it made for a specific customer ended up with Huawei Technologies Co., a potential violation of US sanctions intended to sever the flow of technology to a Chinese national champion.

-

ServiceNow Inc. reported strong third-quarter sales and bookings, but failed to clear the lofty expectations of investors looking for a bigger boost from artificial intelligence.

Earnings Due Thursday

-

Premarket

-

OSI Systems

-

NetScout

-

Rogers Communications

-

-

Postmarket

-

Western Digital

-

VeriSign

-

SPS Commerce

-

Appfolio

-

Rogers

-

Knowles

-

(Adds stock in move in paragraph five at market open)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source link