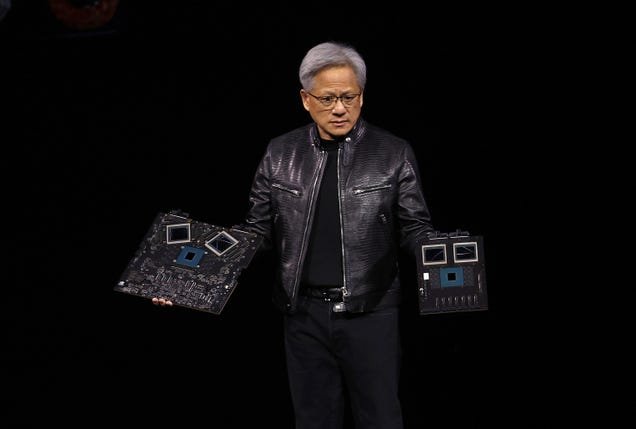

Nvidia’s CEO says a design flaw in its new AI chip was ‘100% Nvidia’s fault’

Nvidia (NVDA) says it has fixed a design flaw in its latest artificial intelligence chips that led to production and shipping delays.

The chipmaker worked with its partner, Taiwan Semiconductor Manufacturing Company (TSM), to resolve the engineering setback in its highly anticipated Blackwell AI platform.

“It was functional, but the design flaw caused the yield to be low,” Nvidia chief executive Jensen Huang said, according to Reuters. “It was 100% Nvidia’s fault.”

The complexity of the project contributed to the setback. The Blackwell computer involved seven new chip designs that needed to be developed and put into production simultaneously, according to Huang.

The problems first surfaced in August, when Nvidia’s stock fell around 8% after a report that Blackwell’s production was delayed due to a design flaw, possibly setting deliveries back by three or so months and impacting major customers such as Google (GOOGL) and Microsoft (MSFT).

During the company’s second-quarter earnings that month, Huang said Nvidia shipped samples of Blackwell to customers and that the AI platform’s production would ramp up in the fourth quarter into the next fiscal year. To “improve production yield,” Nvidia made a change to Blackwell’s GPU mask, the chipmaker said during earnings. However, “there were no functional changes necessary,” Huang said on a call with analysts. The company said it expects to “ship several billion dollars in Blackwell revenue” in the fourth quarter.

“What TSMC did, was to help us recover from that yield difficulty and resume the manufacturing of Blackwell at an incredible pace,” Huang said during an appearance in Denmark to unveil the country’s first AI supercomputer, Gefion.

The recovery appears successful. In October, Nvidia shares got a boost after Huang said Blackwell was in full production and demand for the chip was “insane.”

“Everybody wants to have the most, and everybody wants to be first,” Huang said during an appearance on CNBC.

Nvidia stock closed at a record high of $143.71 per share earlier this week ahead of major technology companies’ earnings. The chipmaker’s shares were down 3.3% during mid-day trading on Wednesday but are up around 189% so far this year.