Nvidia to spend billions in US as it shifts chip supply chain from Asia

This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to get the newsletter delivered every weekday morning. Explore all of our newsletters here

Good morning and welcome back to your daily business briefing. Here’s what’s on the agenda today:

Nvidia’s plans to spend hundreds of billions on its US operations

The Fed cuts its US growth forecasts and raises inflation target

Jeff Bezos makes peace with Maga

Rebuilding LA

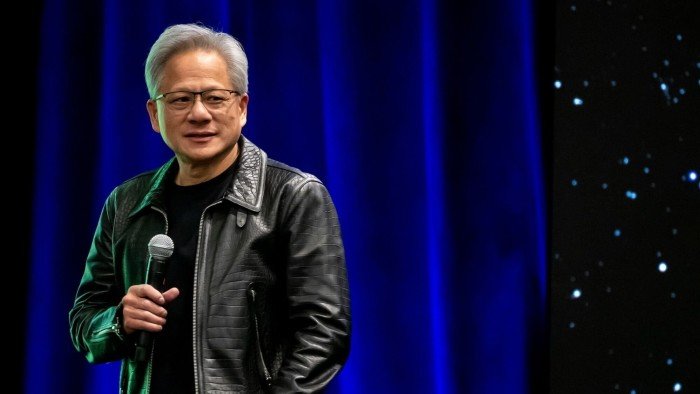

We start with a wide-ranging interview with Jensen Huang, chief executive of Nvidia, who spoke to the Financial Times about the chipmaker’s plans to spend hundreds of billions of dollars over the next four years developing chips.

Huang told the FT his company was planning to tilt its supply chain back from Asia as the impact of Trump’s “America First” trade policies ripples through the global economy. “Overall we will procure, over the course of the next four years, probably half a trillion dollars’ worth of electronics in total,” Huang said. “And I think we can easily see ourselves manufacturing several hundred billion of it here in the US.”

Nvidia this week unveiled its next generation AI chip, Vera Rubin, and outlined plans to build clusters of millions of interconnected chips in giant data centres that will require a vast power supply. “Having the support of an administration who cares about the success of this industry and not allowing energy to be an obstacle is a phenomenal result for AI in the US,” Huang told the FT. Read the full interview where Huang also talks about Intel and Chinese rival Huawei. And there is more AI news below:

Here’s what else we’re keeping tabs on today:

Economic data: The Commerce Department is set to report a widening US current account deficit while Mexico releases fourth-quarter private spending data and preliminary February economic growth figures. Argentina publishes fourth-quarter unemployment data.

Interest rates: The Bank of England is expected to hold UK interest rates steady. For more on monetary policy, sign up for Chris Giles’ Central Banks newsletter if you’re a premium subscriber, or upgrade your subscription here.

Companies: FedEx and Nike report third-quarter results. Chipmaker Micro and consulting group Accenture report second-quarter earnings.

Executive orders: Donald Trump is expected to sign a long-anticipated executive order that aims to shut down the Department of Education. Columbia University faces a federal funding deadline.

EU summit: European leaders gather today for the start of a two-day summit in Brussels to discuss ways to strengthen the bloc’s defence policy. Separately, international military planners meet in London to discuss a peacekeeping force to support Ukraine.

Five more top stories

1. The Federal Reserve slashed its US growth forecast and lifted its inflation outlook, while keeping its main interest rate on hold. Fed chair Jay Powell told reporters that President Donald Trump’s tariffs had affected “a good part” of the central bank’s outlook.

2. Trump proposed that the US take over Ukraine’s nuclear power plants in a phone call with Volodymyr Zelenskyy yesterday. The Ukrainian president also agreed to back an American proposal to halt strikes on Russian energy infrastructure. Here’s more from their call.

3. Colombian President Gustavo Petro has lost his 13th cabinet minister in three months, sending the country’s first leftist government into further chaos with just over a year until the next presidential election. Local media suggested the finance minister Diego Guevara and the president had a bust-up over the country’s widening budget deficit.

4. Israel has started a new ground operation in Gaza, reclaiming territory it ceded as part of a now-shattered ceasefire and threatening further military force if Hamas does not release the remaining hostages held in the strip. The Israeli military issued forced evacuation orders to Palestinians in the border areas as its troops retook parts of the so-called Netzarim corridor.

5. China is boosting state support for domestic minerals exploration as policymakers pursue the country’s goal of self-sufficiency amid intensifying competition with the US. At least half of China’s 34 provincial-level governments announced more subsidies or expanded access for mineral exploration in the past year, an FT analysis shows.

Today’ big read

In the past year Jeff Bezos, the Amazon founder and owner of the Washington Post as well as rocket maker Blue Origin, has executed a sharp public reversal in his relationship with President Donald Trump that has surprised even longtime associates. How did the world’s second-richest person make up with Maga?

We’re also reading . . .

🎧Mexico: The decision three decades ago by Mexico to open its economy and engage with the US is being severely tested. Economist Luis de la Calle discusses what impact the threat of Trump’s tariffs is having on Mexico’s economy.

Turkish politics: The arrest of Recep Tayyip Erdoğan’s main rival marks a dangerous turning point in the country’s authoritarian slide, say politicians and investors.

LA: Public discussion has turned to how to inspire a demoralised city in the wake of perhaps the costliest natural disaster in US history.

Chart of the day

In an echo of the “meme stock” craze of 2021, a handful of European stocks have become a battleground for retail traders taking on hedge fund short sellers. Small-scale traders — some co-ordinating their efforts on Reddit — have turbocharged gains in these companies, which have far outstripped a broader rally led by the defence sector.

Take a break from the news . . .

Securing a restaurant reservation has never been harder. Thankfully, our food columnist Ajesh Patalay has insider tips for landing a table.

Source link