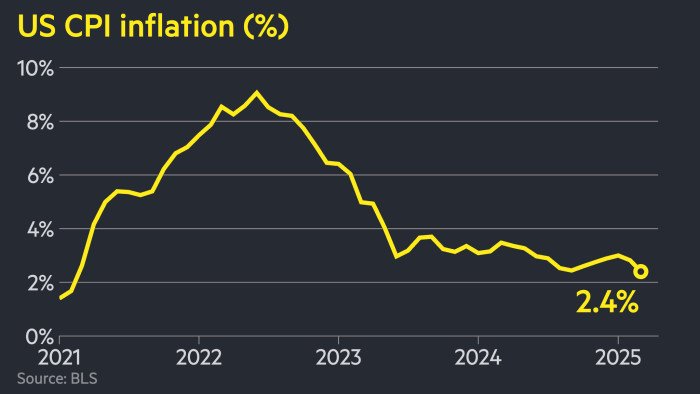

US inflation falls more than expected to 2.4% in March

Stay informed with free updates

Simply sign up to the US inflation myFT Digest — delivered directly to your inbox.

US inflation fell more than expected to 2.4 per cent in March, as the Federal Reserve grapples with how to respond to President Donald Trump’s abrupt U-turns on tariffs.

Thursday’s annual consumer price index figure from the Bureau of Labor Statistics was below both February’s reading of 2.8 per cent and the 2.5 per cent forecast by economists polled by Bloomberg.

The data also showed that annual core inflation rose by 2.8 per cent, less than February’s reading of 3.1 per cent and below economists’ expectations of 3 per cent.

Stock futures trimmed their losses and Treasury yields dropped on the weaker-than-expected inflation data as investors scaled back bets on Fed rate cuts.

S&P 500 futures were down about 2 per cent on Thursday, while the two-year Treasury yield fell to 3.8 per cent, down 0.11 percentage points on the day.

Traders in the futures market modestly cut interest rate expectations, still pricing in between three and four cuts by December.

The central bank faces a dilemma over whether to cut rates to prevent a possible slowdown triggered by Trump’s sweeping tariffs on US trading partners, or hold them higher to pre-empt a resurgence of inflation.

On Wednesday, the US president announced that he would pause steep “reciprocal” tariffs on US trading partners for 90 days. The move sent US stocks soaring, with the S&P 500 posting its best day since 2020.

However, China was denied a pause and its rate increased to 125 per cent, while the 10 per cent tariffs already imposed on most countries remained in place.

Eric Winograd, chief economist at AllianceBernstein, described the latest inflation figures as “very good news”. “There’s less pressure on the Fed to ease,” he added, noting that he anticipated the first interest rate cut of the year in June.

Winograd said that the low annual core inflation figure meant “the Fed has a little bit of wriggle room, or bandwidth” in the face of a potential economic “deterioration” from tariffs.

The March figures predate the US’s implementation this week of a 10 per cent universal tariff, along with huge duties on Chinese goods — factors that are expected to be inflationary.

Federal Reserve officials have noted in recent weeks that the tariffs are likely to boost inflation and slow growth.

Minutes from the central bank’s March policy-setting meeting showed that the “majority of participants noted the potential for inflationary effects arising from various factors to be more persistent than they projected”.

Subadra Rajappa, head of US rates strategy at Société Générale, called the figures “welcome news” but added that “really what the market is going to be looking at is the impact of tariffs on inflation going forward”.

Source link